RiskSeal is a Digital Credit Scoring platform. The solution is intended for credit scoring through digital footprint analysis.

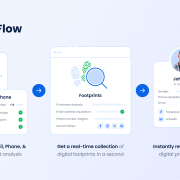

RiskSeal analyzes the borrower’s email, phone number, IP address, name, location, and photo, then evaluates their digital footprint from 200 online and social media platforms.

With just a single API call, RiskSeal provides fintechs with 400+ real-time customer insights, a detailed client profile, and a ready-to-use digital credit score.